Managing loan repayments is a critical aspect of maintaining the financial health of any business. Whether you’re a small business owner or managing a large enterprise, balancing loan repayments alongside operational costs can be challenging.

Failing to manage these payments effectively can lead to higher interest, penalties, and a strain on your cash flow. In this article, we will explore strategies for effectively managing loan repayments to ensure your business remains financially stable.

1. Prioritize High-Interest Loans

One of the most effective strategies for managing loan repayments is to prioritize high-interest loans. These loans can quickly accumulate additional debt if left unpaid for too long. By paying off high-interest loans first, you reduce the amount of interest you’ll end up paying over time, freeing up cash for other expenses.

High-interest loans can be particularly challenging for businesses to pay off, as they increase the cost of borrowing and can put a significant strain on cash flow, especially in uncertain economic conditions. For businesses, these loans not only increase operating costs but also limit reinvestment opportunities and slow down growth.

Hypothetically, if you are a business owner with a business debt, your annual payment will increase over the long run depending or over the years. If this problem will not be addressed this will affect the operation of your business.

North Dakota (8.50% interest):

United States Average (9.37% interest):

Mississippi (9.99% interest):

It only shows that high annual interest outlays can put financial strain on a business, especially if debt levels remain high and the business cannot consistently reduce the principal.

To mitigate this impact, consolidating debts or negotiating lower interest rates with lenders can be effective solutions. This approach can reduce annual interest expenses, freeing up cash for reinvestment in the business and ensuring better financial health over the long term.

Tip: Review your current loan agreements and identify which loans have the highest interest rates. Prioritize paying these off first while continuing to make minimum payments on your lower-interest loans.

2. Consolidate Multiple Loans

If your business is juggling multiple loans, each with different interest rates and repayment schedules, consolidating them into one manageable payment can help streamline the process. Debt consolidation combines several loans into a single loan with one payment schedule, often at a lower interest rate. This reduces the burden of managing multiple payments and can improve your cash flow.

Business Debt Adjusters help businesses consolidate multiple loans by combining them into a single loan with a unified payment schedule and often a lower interest rate. Here’s how Business Debt Adjusters consolidate your multiple business loans:

Additionally, this process helps the business owner for a fast business relief service and will give them the following benefits:

Consolidation offers a streamlined approach to managing business debt, improving financial stability and allowing business owners to focus more on growth than on managing debt repayment.

Learn more about debt consolidation here: Debt Consolidation for Small Businesses.

3. Renegotiate Loan Terms

If your business is struggling to meet its loan repayment obligations, it’s important to communicate with your lenders. Many lenders are willing to renegotiate loan terms, especially if they understand the financial difficulties you are facing. This may involve extending the repayment period, reducing interest rates, or offering temporary deferment.

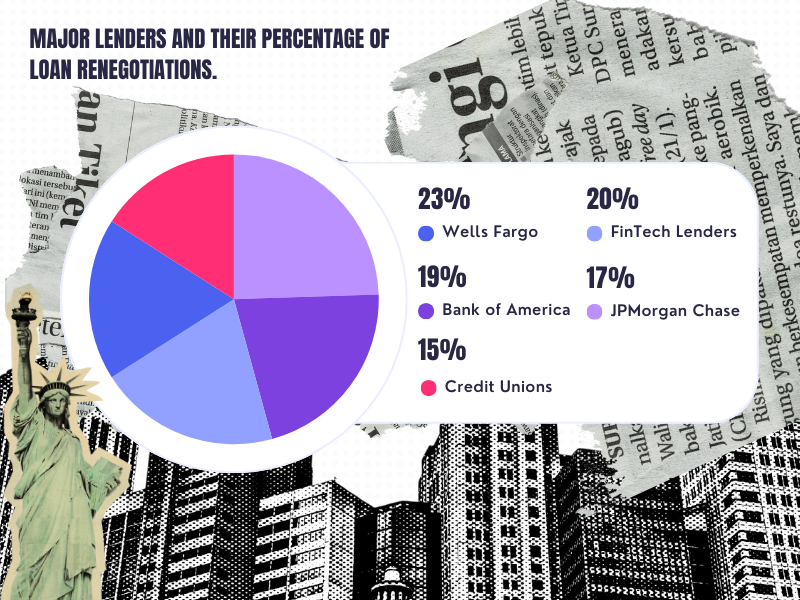

Here is a summary of a few major lenders and the percentage of loan renegotiations they have undertaken with business clients in recent years:

These adjustments helped business owners by improving liquidity and reducing immediate financial pressures, as lenders aimed to support client retention amid economic difficulties

Tip: Reach out to your lender before missing a payment. Lenders are more likely to work with you if you initiate the conversation proactively.

4. Automate Your Payments

Setting up automatic payments ensures that you never miss a due date, which can help maintain your business’s credit rating. To avoid late fees and penalties, consider automating your loan payments. Many banks and lenders offer this option, and it can give you peace of mind knowing that your payments are being made on time.

How Late Fees and Penalties Add to the Problem:

Falling into a cycle of unmanageable debt payments can have severe consequences, not only for your business but also for your personal well-being. Once you’re caught in this spiral, missed payments can snowball into an increased financial burden as late fees of 5% to 15% on missed payments accumulate, driving up the total amount owed.

This compounding cycle of debt can quickly feel like a never-ending struggle, impacting your ability to keep up with repayments and ultimately harming your credit rating. A damaged credit score makes it more challenging and costly to secure future financing, potentially raising interest rates on subsequent loans by 1% to 5%, while also increasing the likelihood of facing legal action from creditors.

Beyond financial strain, constantly dealing with debt-related issues diverts critical time and resources from growing your business and maintaining a balanced life, leading to significant stress and diminished personal well-being.

How Proper Management Can Avoid Additional Costs:

Supporting Data and Statistics:

Tip: If possible, set up a dedicated business account for loan payments. This ensures that your loan payments remain separate from your other business expenses, making it easier to track and manage your cash flow.

5. Set Up a Repayment Schedule

Having a repayment schedule in place helps you stay on top of your obligations and provides a clear overview of what needs to be paid and when. Create a loan repayment calendar that outlines the due dates of your loans, the amount due, and any applicable interest. This can help you budget effectively and ensure that you have the funds available for each payment.

Tip: Keep your loan repayment schedule visible and update it regularly to account for any changes or new loans.

Conclusion:Effectively managing loan repayments is essential to maintaining a healthy cash flow and keeping your business on solid financial ground. By prioritizing high-interest loans, consolidating where necessary, and setting up automated payments, you can stay on top of your obligations and reduce financial stress. For more information on loan management strategies, check out our Guide to Debt Management.